A Critical Look at the Kroger-Albertsons Merger

A Critical Look at the Kroger-Albertsons Merger: Protecting Our Food System and Local Communities

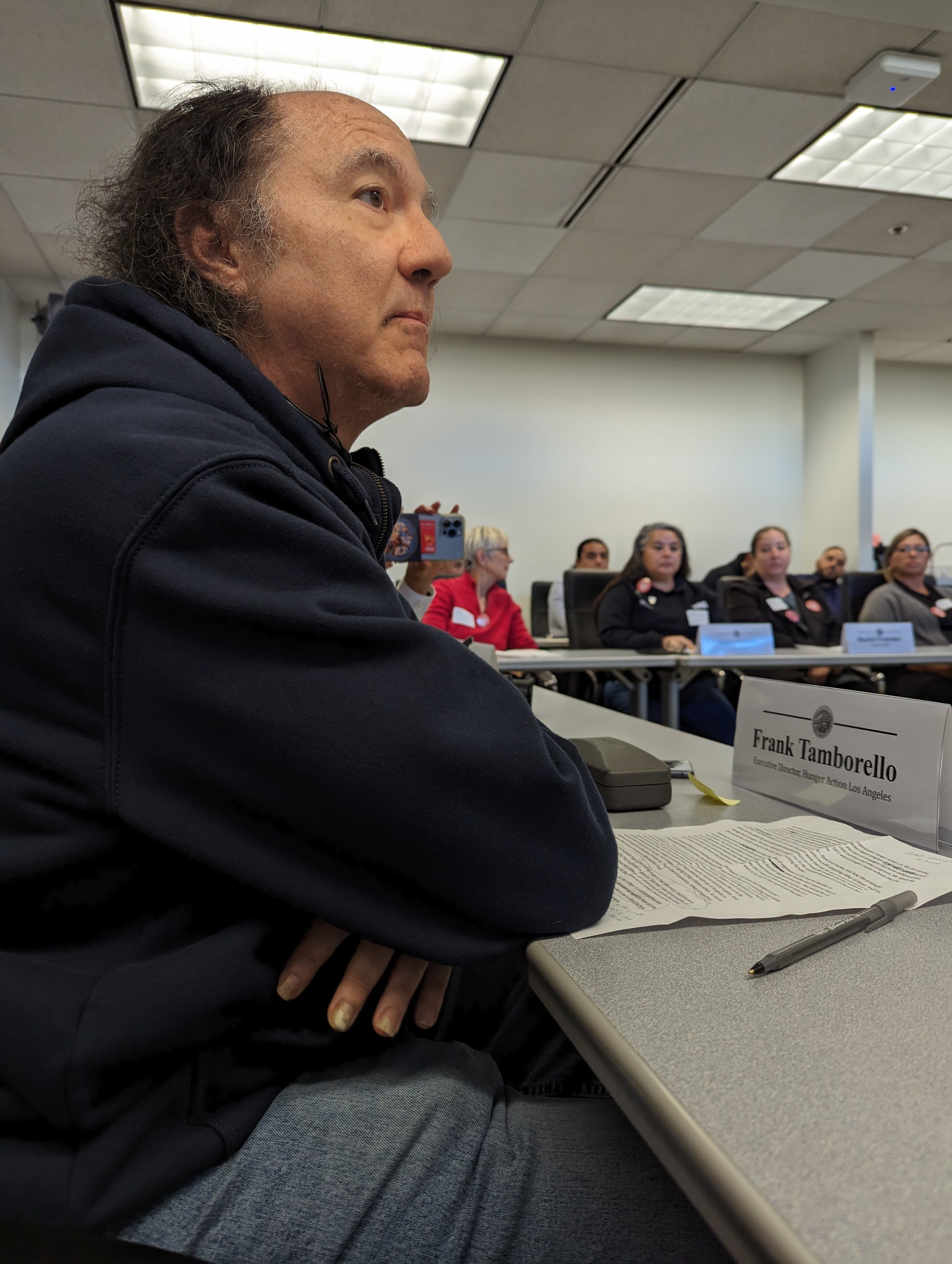

On December 14th, 2023, UFCW 770 invited Los Angeles Food Policy Council, Hunger Action LA, and other community groups and food equity advocates the opportunity to express our collective concerns to Attorney General Rob Bonta regarding the monumental Kroger-Albertsons merger. In the public comment, Los Angeles Food Policy Council views this $25 billion deal, positioned to be the largest grocery chain merger in history, with a critical eye, particularly focusing on its potential impacts on food system volatility, economic vulnerability, and the well-being of local and small suppliers, including farmers in addition to the undeniable result of massive layoffs within the food industry.

Food System Volatility:

In an effort to meet antitrust law requirements, Kroger has informed the Federal Trade Commission (FTC) that it intends to sell 413 Kroger and Albertsons stores to C&S Wholesale Grocers once the merger is approved. This could result in reduced access to healthy foods in predominantly low-income communities. For example, in the Albertson-Safeway merger, 100 stores were divested to Haggen Foods & Pharmacy, but Haggen's subsequent bankruptcy led to the closure of many of these stores. Additionally, Albertson itself closed an additional 100 stores. This historical and recent example raises concerns about the long-term viability and stability of the stores divested as part of the Kroger-Albertsons merger. If a similar pattern occurs, where the new owner faces financial difficulties or strategic restructurings leading to store closures, it could result in significant reductions in food access, especially in communities that have limited grocery options. This possibility highlights the need for careful scrutiny and planning in the divestiture process to ensure that communities do not suffer from reduced food access due to store closures or consolidations following such mergers.

Increased Economic Vulnerability:

The proposed Kroger-Albertsons merger raises significant concerns about increasing economic vulnerability in the food chain and altering the food landscape, potentially with adverse environmental impacts. As the Center for Science in the Public Interest pointed out, such can amplify the buying power of large grocery corporations, effectively undercutting the competitive ability of smaller stores and suppliers. This increased market dominance can lead to the marginalization or even the exit of smaller, community-based grocers and regional chains. The loss of these smaller businesses reduces consumer choice and increases food deserts, diminishing the diversity of supply chains. This could lead to relying on few large suppliers, increasing the risk of supply chain disruptions.

Environmental Impacts:

With mergers, the threat to our economic development is also seen as a risk to our environment. When large corporations prioritize profit, there can be significant environmental consequences. The drive for efficiency and cost-cutting might lead to practices that are less sustainable like prioritizing large-scale industrial farming over smaller more ecologically friendly agricultural practices. This could accelerate issues with soil degradation, water resource depletion, and loss of biodiversity.

Impact on Farmers:

The Kroger-Albertsons merger will exacerbate difficulties for local farmers and small suppliers who are already facing challenges and barriers. With fewer buyers, they have less ability to negotiate with grocery chains. Generally, the larger size of the combined retailers will increase their purchasing power, granting them the ability to force down prices paid to contracted suppliers, including producers and farmers, leading to lower prices paid for their produce, meat, dairy, and other products. Such a merger will not only threaten to lower the prices paid to our producers for their products but also highlights the looming threat of monopolistic practices in the grocery retail sector. The necessity of implementing policies to counteract these monopolistic tendencies itself questions whether a merger should be allowed. We must prioritize the protection of our agricultural sector and maintain a competitive market that ensures fair pricing and supports the economic sustainability of our small and local producers.